A medical student was given an option regarding how to pay his college loan. He could decide on a 24 month contra, a 48 month contract or a 72 month contract. The shorter one resulting in higher payments and the 72 month one resulting in lowest of payments.

Confused, the student called a friend who worked as a CPA in a Manhattan accounting firm. His friend suggested to him that he should accept the longest contract (72 months), because even though the interest will be a bit higher, the extension of time that the payments will be disseminated will result in it being more economical as the years go by.

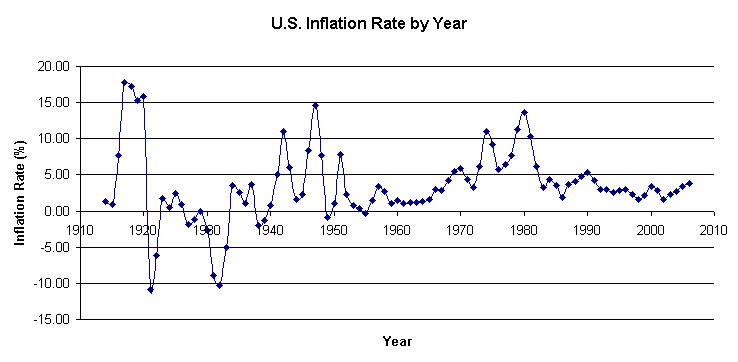

The CPA was talking about inflation – the increase in the general level of prices for goods and service over time. As per Investopedia, “As inflation rises, every dollar you own buys a smaller percentage of a good or service.”. Thus, an $80.00 payment today will mean a lot less in 2020, meaning what you could buy for $80.00 today, you will be buying less in 2020.

It is estimated that the inflation rate is 2% annually; this, $10.00 item will cost $10.20 a year later, and so on.

Inflation can be broken down into a number of categories:

-

Deflation

This is the opposite of inflation and the prices of goods and services actually go down.

-

Hyperinflation

Rare, but if it occurs, can lead to the breakdown of a nation’s monetary system.

-

Stagflation

A combination of high unemployment and economic decadence.

As of today, there is no steadfast rule that defines inflation; however, there are some theories:

Demand-Pull Inflation – Those of us who have taken a college economics class have been taught that when there is a shortage of a commodity that is high in demand, its price rises and when this community is in huge supply, its price diminishes. Some call it “too much money chasing too few goods”. A very good example are the gas prices. During the Arab oil strike in the 1970s, the price of gas was inflated by a huge amount and after hurricane Sandy, the price of gas also increased, due to the fact that many gas stations were shut down, as they had no electricity to pump the gas.

Cost-Push Inflation – As the chain reaction of costs go up, employers need to do the same; such as raise the costs of imports or services and/or decrease the salaries of employees. Other possibilities might be to change insurance plans, so that the company pays less for the plan, but the employee is forced to pay more over copays, deductions or other additional medical expenses.

With all that is said about inflation, it is interesting to note that this is a positive thing, as it a sign that the nation’s economy is growing.

How do you beat inflation? Make sure you save for the future. That could be building your IRA, investing in stocks bonds or precious metals or even collecting items of value.

What Makes Me Different From the Others?

What Makes Me Different From the Others?