Recent surveys are showing that while overall poverty rates in the United States are falling, they are rising for Americans over age 65.

According to the latest U.S. Census Bureau data, the share of older people (over 65) living below the poverty line rose to 10.3% in 2021, up from 8.9% in 2020. The increase means that an additional 1 million older adults have fallen below the poverty threshold, bringing the total number of seniors in that unfortunate category to nearly 6 million, according to an analysis by the National Council on Aging (NCOA).

Another organization, The Senior Citizens League, a Washington-based advocacy group, ...

Read More...

Are Guarantees of Student Loans Changing The Retirement Landscape?

If you think student loan debt is a problem for the younger generation, think again. According to the Consumer Financial Protection Bureau (CFPB), about 2.8 million people age 60 and older have outstanding student loans – four times the number in 2005. Most of the current student-loan debts of people 60-plus were incurred paying for college for a child or grandchild, and in the past decade, for the 60 to 64 age group, student-loan debt has increased eight-fold – to $38 billion!

“Americans in their 60s are now the fastest-growing age group facing student loan debt,” says Andrew Anable, a financial planner at Safeguard Investment Advisory ...

Read More...

Two Personal Finance Issues That Are Not Going Away in 2018

It's a new year and, unfortunately, many of us continue to grapple with financial issues that do not want to go away. Here are two to think about:

Not savings enough for retirement.

I have encountered countless clients who, although having worked for years, have accumulated little or no retirement savings. They have allowed debt to control their lives and have sacrificed savings opportunities in the process. This perspective must change.

Bankruptcy can be a first step toward achieving financial security. Did you know that retirement savings are fully protected from your creditors - even in bankruptcy? Whether you have one ...

Read More...

Eight Nifty Ideas for Making Money

Some people may know about these ideas, but don’t look at them seriously enough until they are in a financial predicament and even then, they may not think about them. If you have fallen into a financial hardship, whether it is from a lost job, unexpected medical bills, divorce, unexpected home expenses or anything else, you may want to spend some time looking into the following:

Car Company Promotions

There are times when car dealerships run some amazing offers. These offers are not to buy a car and they do not pressure you to do so. What they do offer is a chance to ride in a new vehicle for free, including free gas for the day and along ...

Read More...

Common Myths About Saving for Retirement

It goes without saying that one should plan early for their retirement nest egg and for those lucky enough to be working for a firm that provides an IRA or compatible retirement plan, you are off to a good start. For those that do not have a retirement plan with their employer or you are in business for yourself, there are many options available to you as well. According to a study by the Economic Policy Institute, the average family puts away only $5,000 for retirement and 43% of Americans don’t have any retirement savings at all. These statistics can be scary. What leads people to shy away from investing in their future are many. Here are a ...

Read More...

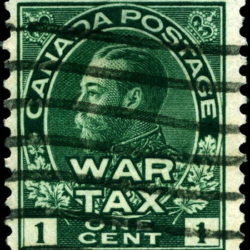

Stamp Collecting – Another Hidden Treasure

Probably, the most popular of collectibles, stamps have been around of over 200 years, with the first American stamp issued in July 1, 1847, as Congress authorized the Postmaster General to publish a stamp of George Washington.

Although stamps are nothing more than small pieces of paper, they represent history, with locations that are images of historical places, famous personalities or specific historical events, and as such, they become a tool for learning. In so doing, parents should encourage their children to start stamp collecting, as not only will they be early educated, but they would begin to accrue a monetary value for years to ...

Read More...

Investing 101: How the Stock Market Works?

A stock market presents a great opportunity for investors to earn a large return on investment (ROI). It is like a double edged sword. By investing in the stock market, you can earn double digit returns on your investments or more, but you also can sustain loses as well*.

In order to successfully trade in these financial exchanges, you need to learn the basics of stock market investing. The more you know about the stock trading and how it works –the more you can achieve the ability to make winning moves, and growing your wealth.

Stock Market: An Introduction

A stock market or stock exchange is a place where a company’s shares can be ...

Read More...

Collecting Old Coins – A Hidden Treasure

Haven’t we all heard about grandma's or grandpa’s collection of old coins, stamps or electric trains that are just building dust in their basement or attic? Well let grandma know that she might have accumulated a small fortune and not even know it.

There are also those who are active collectors, but do not realize that the collections that they have might well be a hidden treasure of valuable merchandise.

Let’s talk about old coins. Here you have not just face value of the item, but also the suggested value of the coin itself.

How Do You Determine if a Coin is Worth More Than Its Face Value?

There are many ways to find out if the coin ...

Read More...

Seven Ways Young People Can Start Building for Their Retirement

Some people wait until they are in their 40s or 50s before they get concerned about their financial future. Although it is never too late to prepare for your retirement, you should start early. If you are in your 20s, this is the perfect time to start building for your financial future.

Below are five interesting ways where you can start building your nest egg:

Stock Up Now and Reap in the Rewards Later

If you don’t know anything about the stock market, that’s OK. You can call any other the major investment banks and they will guide you on how to start investing. However, some people like to do it themselves. Some of the benefits of self ...

Read More...

What Makes Me Different From the Others?

What Makes Me Different From the Others?