American consumers are now more indebted than ever. A recently released Federal Reserve Consumer Credit report shows that U.S. consumer credit outstanding has reached historic levels as outstanding consumer credit is now at $4.7 trillion. In August, consumer credit increased at a seasonally adjusted annual rate of 8.3 percent. The previous rise in July had been 6.%.

These current levels of consumer debt show that the Federal Reserve raising rates has not slowed down consumer borrowing. While consumer credit declined in the years immediately after the 2007 – 2009 financial crisis, since the second quarter of 2011 until the second quarter of ...

Read More...

The Economy Under the Upcoming Trump Administration

The Question of the US Economy for 2017

Experts on all sides are weighing in regarding what the future economy will be like for the next four years. This is not a simple task. There are many factors to consider. For example, what will happen to the nation’s economy if the NAFTA trade agreement is nullified? What about the job market? Will jobs increase? Will the ‘repeal and replace’ of Obamacare help or hinder the economy? What will happen to interest rates of saving accounts, mortgages and credit cards? Will there be an epidemic of personal and business bankruptcies or a substantial decrease of debt? How will the stock market react to these ...

Read More...

What is Inflation?

A medical student was given an option regarding how to pay his college loan. He could decide on a 24 month contra, a 48 month contract or a 72 month contract. The shorter one resulting in higher payments and the 72 month one resulting in lowest of payments.

Confused, the student called a friend who worked as a CPA in a Manhattan accounting firm. His friend suggested to him that he should accept the longest contract (72 months), because even though the interest will be a bit higher, the extension of time that the payments will be disseminated will result in it being more economical as the years go by.

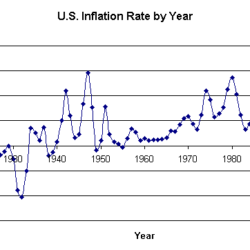

The CPA was talking about inflation ...

Read More...

What Makes Me Different From the Others?

What Makes Me Different From the Others?