Despite the Credit Card Act of 2009 , the credit card industry is the only one that still has the right to change the terms of a contract after it has been signed. Many consumers sign up for a credit card when the interest rate is low, such as 7.9% per year. Then they miss a payment or are even just a few days late on a payment and the credit card issuer raises the rate. The new increased rate now applies for the entire unpaid balance on the card, even though the balance was charged when the old rate was in effect. It is this terrible cycle that keeps consumers in debt forever, because they end up paying interest on interest. Often, items ...

Read More...

HOW TO: Stop Harassing Phone Calls from Debt Collectors

With economy hurting and unemployment reaching record levels, harassing phone calls from debt collectors have become a way of life for many Americans. My clients inform me that collection agency calls can be rude, threatening, and manipulative. For some, the calls are so bothersome that phone numbers have to be changed or disconnected to stop debt collection calls. Many consumers don’t realize that they are guaranteed protection under the law. The Fair Debt Collection Practices Act (FDCPA) has very clear rules about what debt collectors are allowed to do and not to do:

WHY THEY CAN CALL

First, they can only call you about debts that they ...

Read More...

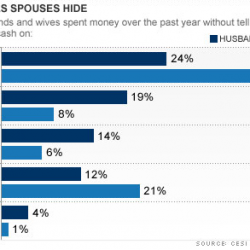

Do You Hide Purchases From Your Spouse?

A few weeks ago, I wrote a blog post discussing the reasons why bills should be spoken about openly in your family. This is particularly important if one spouse becomes ill or even if the family wants to try to keep a monthly budget.

Unfortunately, according to a 2010 survey by CESI Debt Solutions, as reported on Yahoo, approximately 80% of all married people surveyed hide some purchases from their spouses. The most common reason that was listed was to avoid conflict or criticism from their partner. The survey also showed that men were somewhat more likely to do so more often then women. Even though the majority of those surveyed admitted to ...

Read More...

10 Horrible Habits That Will Make a Mess of Your Finances

Many people that find themselves in debt seem to make some common financial mistakes that contribute to their debt problems. According to an article on MSN.com, there are ten bad financial habits that can lead to financial disaster:

Misuse of balance transfers - If you aren’t going to stop charging on your cards, transferring balances to lower interest cards won’t get you out of debt in the long run.

Disregarding your credit report because you think you can’t change it anyway - It is essential that you frequently check your credit report. Small errors made by your creditors could raise your interest rates, lower your credit score and ...

Read More...

Patterson Signs Bill Increasing Exemptions in Bankruptcy

Governor David A. Paterson announced on December 23, 2010 that he signed into law S.7034-A/A.8735-A, which will increase the amount of exemptions in bankruptcy proceedings and money judgments and provide a choice between State and Federal exemptions.

"During this time of economic crisis, it is our responsibility as public servants to protect those who are struggling the most," Governor Paterson said. "A reconsideration of the current exemptions, which in some cases have not been changed in decades, is particularly warranted when an increasing number of individuals find themselves in dire financial condition. Though this is not a perfect ...

Read More...

The College Debt Bubble is Ready to Explode

For the first time ever, student loan debt has surpassed credit card debt. Over the last decade, young people have eagerly received hundreds of thousands of dollars from private lenders working with financial aid offices to earn bachelor’s degrees. According to Yahoo, thanks to easy credit, declining grants and growing tuitions, more than two-thirds of students graduated with debt in 2008, up from 45% fifteen years ago. Outstanding student loan debt ballooned, it grew roughly four-fold in the last decade to $833 billion, with the average debt load being $24,000 according to the Project on Student Debt.

If that wasn’t bad enough, defaults ...

Read More...

Banks Facing Another Mortgage Crisis

Wall Street banks have paid back their federal bailout money and are on the road to recovery, but the financial crisis continues for Main Street banks that small businesses rely on for capital. According to this Barron’s article featured on Yahoo, banks could lose more than $100 billion in another mortgage crisis over the next few years as the backlash from the bailout begins:

The potential liability facing bankers arises from the $2 trillion in subprime, alt-A and option-adjustable rate mortgages that they underwrote and sold to investors, mostly as mortgage-backed securities during the home-lending boom of 2005 to 2007. The losses on the ...

Read More...

Renter? 10 Things You Won’t Hear From Your Landlord

Whether because of the bad housing market or a negative balance in their savings account, many are stuck renting an apartment. With the many positives like no yard-work, come many negatives. According to Smart Money, there are ten things your landlord will never say to you. Here is a quick summary:

“This building is in foreclosure." - Congress passed the Protecting Tenants at Foreclosure Act, which gives tenants at least 90 days from the foreclosure sale to move out (up from 30 days previously.) Provided the owner

“You should complain more.” - Most states require landlords to keep the property in good repair, with home systems and ...

Read More...

How is Credit Reported During a Bankruptcy?

The Fair Credit Reporting Act (FCRA) mandates that the credit bureaus correct errors within 30 days of notification. However, creditors are not required to make any reports on your credit while you are going through the bankruptcy process, which could be anywhere from a few months for a Chapter 7 to 5 years on a Chapter 13 case. When making payments under Chapter 13, many creditors will not report this activity for fear of violating the automatic stay that is put in place when a debtor petitions for bankruptcy. This stay prevents a creditor from taking any further action to collect debts – and some take this a step further to include ...

Read More...

7 Tips to Help You to Modify Your Mortgage

Many homeowners are getting burned by reputable loan modification agencies and are being forced to file Chapter 13 bankruptcy to try and save their home from foreclosure. South Carolina attorney Dana Wilkinson gives seven tips to avoid this predicament when you are in the loan modification process in her recent article on BankruptcyLawNetwork.com. Here is a brief summary:

Keep a copy of EVERYTHING – Keep a separate file for any correspondence between you and your mortgage lender. If possible, keep notes of every conversation.

If it’s Not in Writing, Assume it isn’t True – Borrowers must have any important information regarding their loan ...

Read More...

- « Previous Page

- 1

- …

- 5

- 6

- 7

- 8

- Next Page »

What Makes Me Different From the Others?

What Makes Me Different From the Others?