The Senate has passed a bill that would roll back some banking regulations. Indirectly, the bill addresses Equifax’s historic data breach in which Social Security numbers and other personal data of 150 million people were exposed — a number that comprises well over half the U.S.’s adult population.

Though Sens. Mark Warner (D-Virg.) and Elizabeth Warren (D-Mass.) had put forth a bill in January that would hold credit reporting agencies responsible for breaches, it did not progress and Congress had failed to issue a legislative response to the Equifax breach.

In a move meant to benefit consumers, the new Senate bill, which was introduced ...

Read More...

Consumer’s Appetite For Debt On the Rise

Interest rates are on the rise, but that hasn’t curbed Americans’ appetite for consumer debt. If anything, consumers are borrowing more on credit cards or through auto loans than they have in years, and lenders seeking growth are happy to oblige them.

Recently, a male millennial said he signed up for more than five credit cards over the past year, from issuers including Capital One Financial Corp. and Discover Financial Services, after he received offers in the mail. He also took out a $36,000 loan to buy a new Jeep Grand Cherokee. This individual, who rents, said the offers have been arriving as his credit score has improved. He ...

Read More...

VantageScore – Credit Scoring Game Changer?

Various sources have reported that lenders are increasingly using VantageScore to determine credit worthiness. You need to know what it is and why it could be a game changer.

VantageScore is a credit scoring model that first emerged in 2006 as a joint venture of the big three credit bureaus — Experian, Equifax and TransUnion — and now has the distinction of being one of only two scoring models lenders rely on to make lending decisions (the other being FICO). VantageScore currently claims about 10% of this hard-to-crack market for credit scores used in the lending industry, with the greatest adoption seen among the largest banks and ...

Read More...

Don’t Ignore Your Credit Report

It pays to be familiar with your credit report. The information it contains determines your credit score, your ability to access credit and loans, and even your chances of landing a job or signing a lease. It's a good idea to check your credit report on at least an annual basis. In certain scenarios, however, you should closely monitor your credit report no matter when you last checked it. Here are six times you need to check your credit report.

Debt Collectors are Calling

If you're getting calls from debt collectors regarding unpaid bills, you may need to do some damage control. Whether the debt in question is valid or not, it could ...

Read More...

Have You Been Rejected for a Mortgage? Get a Grip and Fight Back

How many Americans are rejected for a mortgage loan on an annual basis?

Data are scarce on the topic, but a Federal Reserve study shows that one in eight Americans were turned down for a mortgage in 2015 -- and overextended credit was at the top of the list of reasons lenders used to reject mortgage applicants. The Federal Reserve study pointed out that a high debt-to-income ratio -- i.e., the amount of money you borrow against the amount of money you make -- was a top credit-based reason for mortgage rejections.

If you've been turned down on a mortgage loan due to bad credit, get a grip and fight back.

Sure, the bad news is that ...

Read More...

How Parents Can Help Their Children Apply for Credit

John was a college student who was working to establish credit so that he can build a good financial future. One month there was an oversight and he missed his car lease payment by a few days. He panicked, thinking that his credit was ‘ruined’. Fortunately, his parents set him straight about how the credit ranking system works. But what was exactly wrong with their son’s understanding that set off his panic state? Students should be taught ahead of time the truths and myths of obtaining credit, specifically, John should have been told the following:

Unless he is 30 days (or more) behind on a payment, his credit will not be affected. ...

Read More...

Buying a Car with Bad Credit

Many people who shop for cars usually go directly to the dealer’s finance office after they decide on the car they want to buy. This procedure is ideal for those who have good or outstanding credit, but may not be the best solution for those with poor or bad credit.

Below are some tips for acquiring a car loan when you credit is considered fair or poor

Shop Around

Don’t rush into a deal. Take the necessary time to shop around and never take the first loan offered. Try your local bank or go to a few different banks. You may also want to try a credit union. Many credit unions offer competitive rates and some will work with you even if your ...

Read More...

Unique Ways to Manage Your Credit

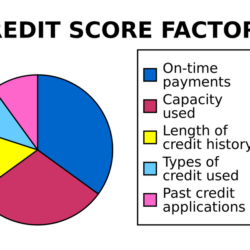

To many, making payments on time and staying below 30% of your balance is all you need to keep a high credit score. Although these are major components that are used in the formulas to determine your credit score, they are not the only ones.

In addition, there are certain metrics that could affect your credit score that you might not normally consider. Let’s take a look at them.

Closing Unused Accounts

One would think that if you are not using a credit card or other loan, such as a line of credit, it would make sense to close it out. Reason being that it would keep your credit file more organized and up to date.

You may be surprised ...

Read More...

How Credit Scoring Works

Years ago, if you applied for a credit card, the banks would check your credit based upon one factor - your FICO score. FICO stands for Fair Isaac Corporation. A data analytics company located in San Jose, California. They developed a computer program that determines your credit score. Every time you apply for a car loan, bank loan, mortgage or credit card, your information is fed into one of the ‘Big Three’ credit bureaus, Transunion, Equifax or Experian, who used this formula to determine your credit rating; however, that has changed now, as there are numerous FICO versions available, as well as other companies that have similar formulas ...

Read More...

Tips for Maintaining Good Credit

There are many ways you can maintain a good credit score. One of the key points is to always be aware of your credit usage, credit score and your financial spending. Following these guidelines will help you maintain good credit and allow you to continue living a financially helpful lifestyle.

Control Your Spending!

This does not apply just to credit cards, but for everything you do. The temptations are always there.to overspend on that new pearl neckless or a new car, because it has options your current car doesn’t have. Be smart and money-wise. You never know when an unexpected financial emergency might happen that could change your entire ...

Read More...

What Makes Me Different From the Others?

What Makes Me Different From the Others?