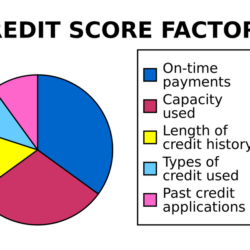

Years ago, if you applied for a credit card, the banks would check your credit based upon one factor - your FICO score. FICO stands for Fair Isaac Corporation. A data analytics company located in San Jose, California. They developed a computer program that determines your credit score. Every time you apply for a car loan, bank loan, mortgage or credit card, your information is fed into one of the ‘Big Three’ credit bureaus, Transunion, Equifax or Experian, who used this formula to determine your credit rating; however, that has changed now, as there are numerous FICO versions available, as well as other companies that have similar formulas ...

Read More...

The Economy Under the Upcoming Trump Administration

The Question of the US Economy for 2017

Experts on all sides are weighing in regarding what the future economy will be like for the next four years. This is not a simple task. There are many factors to consider. For example, what will happen to the nation’s economy if the NAFTA trade agreement is nullified? What about the job market? Will jobs increase? Will the ‘repeal and replace’ of Obamacare help or hinder the economy? What will happen to interest rates of saving accounts, mortgages and credit cards? Will there be an epidemic of personal and business bankruptcies or a substantial decrease of debt? How will the stock market react to these ...

Read More...

Here’s How You Can Permanently Bid Adieu to the Paycheck to Paycheck Lifestyle

You need to set some smart limits on your spending if you’re always stressed about your finances and are living a paycheck-to-paycheck life. Compared to simply earning more, understanding the ways of managing your money will get you further regardless of how much you earn.

You may not believe this but some million-dollar lottery winners became bankrupt in a matter of few years. Why? They didn’t manage their money well. Luckily, you don’t have to suffer the same fate. Beginning this month, start following these six things you can do to avoid financial stress and move away from a paycheck-to-paycheck lifestyle:

Appraise your ...

Read More...

Three Credit Card Mistakes You Should Avoid at All Costs

The way you use your credit card will determine your overall financial health. Using credit cards responsibly will ensure that you do not take on too much high-interest debt. And this is important if you want to avoid hurting your credit score.

Credit cards need to be used responsibly if you want to avoid falling into a debt hole. One misstep or wrong decision regarding the use of credit cards can have serious and long lasting effects on your finances. Below are 3 credit card mistakes that you should avoid at all costs in order for you to remain financially stable and successful.

Avoid the Temptation of Using Credit Cards to Purchase ...

Read More...

Tips for Maintaining Good Credit

There are many ways you can maintain a good credit score. One of the key points is to always be aware of your credit usage, credit score and your financial spending. Following these guidelines will help you maintain good credit and allow you to continue living a financially helpful lifestyle.

Control Your Spending!

This does not apply just to credit cards, but for everything you do. The temptations are always there.to overspend on that new pearl neckless or a new car, because it has options your current car doesn’t have. Be smart and money-wise. You never know when an unexpected financial emergency might happen that could change your entire ...

Read More...

Has This Happened to You?

A typical Scenario of Financial Hardship

Todd is living a financially comfortable lifestyle, with a household gross income $85,000 per year. Todd is married and has two children. Both are attending middle school and they have made plans for a cruise vacation, which is coming next month. The travel agent has been fully paid in advance for the cruise.

In the interim, Todd's mother-in-law became ill and is hospitalized. The prognoses is that she will need to live in a nursing home, because she will need 24 hour care; however, they decide to bring her to home, as that would be the better option. After all, he has an extra bedroom.

Arrangements ...

Read More...

NYS Takes Bold Step To Regulate Collection Lawsuits

On September 16, 2014, the New York State Unified Court System announced new rules to stop debt collection agencies from using underhanded tactics to win judgments against poor or elderly credit card holders.

In the recent past, debt collection agencies frequently score court judgments for the wrong amount of money or even from the wrong person by using incomplete proof or by pressing cases where the statute of limitations has expired. The collection agencies also frequently fail to provide proper notice that a lawsuit was filed – a tactic known as "sewer service."

"While creditors have every right to collect what is legally owed to them, ...

Read More...

FOUR TIPS ABOUT CREDIT AFTER BANKRUPTCY

No matter how many clients I have worked with over the past 25 years, the greatest concern of the vast majority of them is “How long will it take me to re-establish credit after I file Chapter 7 Bankruptcy?”

While there is no hard and fast rules of thumb, it is much easier than you think. Here are four tips to consider:

1. Keep any manageable debts you can after you file. In most cases, student loans can’t be discharged by bankruptcy. Other times, clients may choose to continue making payments on a car loan. Assuming that you can afford the monthly payments, it makes sense to maintain your student loan and/or auto payments after your ...

Read More...

Bankruptcy Filings Are Down – But That Doesn’t Mean People Do Not Need to File

Reuters reported today that the number of U.S. businesses and consumers filing for bankruptcy fell 14 percent in the first half of 2012 and could end the year at the lowest level since before the 2008 financial crisis, according to data released by Epiq Systems.

New bankruptcy filings fell to 632,130 in the first six months of the year compared to the same period last year, according to Epiq Systems Inc, which manages documents and claims for companies in bankruptcy.

The number of businesses filing for bankruptcy dropped 22 percent to 30,946 and the number of consumers seeking court protection from creditors fell 13 percent to 601,184.

"We ...

Read More...

Credit After Bankruptcy – Now Easier That Ever

It’s looking like 2005 all over again for credit cards....

The New York Times reported this week that credit card solicitations, particularly for those individuals who have tarnished credit or have previously filed bankruptcy, rose substantially during the fourth quarter of 2011. Credit card lenders gave out 1.1 million new cards to borrowers with damaged credit in December, up 12.3 percent from the same month a year earlier, according to Equifax’s credit trends report released in March. These borrowers accounted for 23 percent of new auto loans in the fourth quarter of 2011, up from 17 percent in the same period of 2009, Experian, a credit ...

Read More...

What Makes Me Different From the Others?

What Makes Me Different From the Others?