Baby boomers may recall a commercial in the 1980s that referenced a start up company on their exchange whereby the company’s net worth eventually reached $3 billion. At the end of the commercial, they mentioned that the company was Microsoft. The idea behind this advertising was to bring to the attention of American businesses the the NASDAQ stock exchange is the right place to list their company, as they too were becoming a growing company and worth being listed on.

What is the NASDAQ?

The NASDAQ (National Association of Securities Dealers Automated Quotations) was founded in 1971 by the National Association of Securities Dealers ...

Read More...

How Money is Made

Chances are you have seen on TV or in the movies those large printing presses that print US paper currency, but did you know that hundreds of hours of labor is put into the creation and design of each denomination?

Starting with the process to create the paper, onto analyzing, cutting, packaging and then shipping the money to the banks, there are specialists in each department that ensure that the currency that is printed is done as meticulously as possible.

When a new design is forthcoming in one the Bureau of Engraving and Printing facilities (also called the Money Factories), either in Washington, D.C. or Fort Worth, Texas, these ...

Read More...

A Hidden Tresaure – Model Trains

If you have a model train collection, whether it be a full layout of diesel and steam combinations or you have them on display as collectibles, you may have a potential train gold mine available if you fall into a financial hardship. Although, this might be something that you would prefer not to part with, it is worth at least looking into the value of your collection should the need arise.

The train in the photo above is a collector’s vintage Lionel Scout locomotive and tender, built between 1959 an 1961. It is worth about $35.00 in the condition shown. If this was a mint model, the price could well be $75.00 or more. If you have a ...

Read More...

Buying a Car with Bad Credit

Many people who shop for cars usually go directly to the dealer’s finance office after they decide on the car they want to buy. This procedure is ideal for those who have good or outstanding credit, but may not be the best solution for those with poor or bad credit.

Below are some tips for acquiring a car loan when you credit is considered fair or poor

Shop Around

Don’t rush into a deal. Take the necessary time to shop around and never take the first loan offered. Try your local bank or go to a few different banks. You may also want to try a credit union. Many credit unions offer competitive rates and some will work with you even if your ...

Read More...

Mortgage Debt and Retirement

Lucky are those at retirement age that have their home paid up in full. This helps the retiree achieve peace of mind and a new future to look forward to. But for those who still have a balance with their mortgage company, their dream of living free of debt at retirement could be only a pipe dream.

The Consumer Financial Protection Bureau maintains statistics and one of these statistics record the number of people who have not paid off their mortgage by retirement age. In 2011, 30% of property owners who reached 65 still owed payments on their mortgage. This is an eight point rise from 22% in 2001. Senior citizens also saw an increase in ...

Read More...

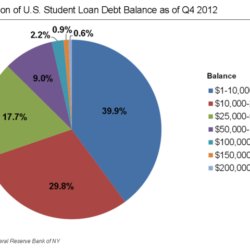

Student Debt May Have a Makeover

While on the campaign trail in an October 2016 appearance at a Columbus Ohio event, Donald Trump made an announcement about college loan debt. “Students should not be asked to pay more on the debt than they can afford … and the debt should not be an albatross around their necks for the rest of their lives.”.

If Trump follows up with making student loans more affordable, it would provide an improvement to the student debt problem that is putting many graduates into financial hardship, with some registering for debt settlement and others filing for bankruptcy.

Let’s take a look and see how this will work:

Change of Chiefs

Trump wants ...

Read More...

Unique Ways to Manage Your Credit

To many, making payments on time and staying below 30% of your balance is all you need to keep a high credit score. Although these are major components that are used in the formulas to determine your credit score, they are not the only ones.

In addition, there are certain metrics that could affect your credit score that you might not normally consider. Let’s take a look at them.

Closing Unused Accounts

One would think that if you are not using a credit card or other loan, such as a line of credit, it would make sense to close it out. Reason being that it would keep your credit file more organized and up to date.

You may be surprised ...

Read More...

How Student Loan Services Can Affect Millions of People

If you have taken out a student loan, chances are you have used one of the integral services that work between you and the bank. They act as a kind of liaison that manages the loan and process your monthly payments.

One of these services is called Navient, which is the largest one, has been accused of failing to act on complaints, with allegations that they have been providing mis-information and processing payments incorrectly. This is something that the federal government doesn’t take lightly and subsequently, the government's Consumer Financial Protection Bureau (CFPB) has filed a multi-million dollar lawsuit against them.

Based upon ...

Read More...

Dealing with Debt Collectors

There is a case where a debt collector for a finance company came to the house of a person who owed them money and told him that he may lose his furniture if he doesn’t pay up. The finance company representative then took out a clipboard and wrote down what items were in his house. That was 40 years ago and the laws have changed since then.

However, that does not mean that some debt collectors will not use unorthodox or even illegal methods to get their money back from you. In addition, some might even be calls from scammers. In a case in 2014, a consumer owed money to a local gym. The gym then proceeded to give the account to a collection ...

Read More...

Eight Nifty Ideas for Making Money

Some people may know about these ideas, but don’t look at them seriously enough until they are in a financial predicament and even then, they may not think about them. If you have fallen into a financial hardship, whether it is from a lost job, unexpected medical bills, divorce, unexpected home expenses or anything else, you may want to spend some time looking into the following:

Car Company Promotions

There are times when car dealerships run some amazing offers. These offers are not to buy a car and they do not pressure you to do so. What they do offer is a chance to ride in a new vehicle for free, including free gas for the day and along ...

Read More...

- « Previous Page

- 1

- …

- 7

- 8

- 9

- 10

- 11

- …

- 21

- Next Page »

What Makes Me Different From the Others?

What Makes Me Different From the Others?