Despite the Credit Card Act of 2009 , the credit card industry is the only one that still has the right to change the terms of a contract after it has been signed. Many consumers sign up for a credit card when the interest rate is low, such as 7.9% per year. Then they miss a payment or are even just a few days late on a payment and the credit card issuer raises the rate. The new increased rate now applies for the entire unpaid balance on the card, even though the balance was charged when the old rate was in effect. It is this terrible cycle that keeps consumers in debt forever, because they end up paying interest on interest. Often, items ...

Read More...

HOW TO: Stop Harassing Phone Calls from Debt Collectors

With economy hurting and unemployment reaching record levels, harassing phone calls from debt collectors have become a way of life for many Americans. My clients inform me that collection agency calls can be rude, threatening, and manipulative. For some, the calls are so bothersome that phone numbers have to be changed or disconnected to stop debt collection calls. Many consumers don’t realize that they are guaranteed protection under the law. The Fair Debt Collection Practices Act (FDCPA) has very clear rules about what debt collectors are allowed to do and not to do:

WHY THEY CAN CALL

First, they can only call you about debts that they ...

Read More...

Bankruptcy is Too Important to Face Alone

With the collection of general financial information available online growing on a daily basis, many individuals who may be considering bankruptcy think they know enough about filing bankruptcy online without retaining an attorney oversee their filing. While the bankruptcy law is clear and an individual is not prohibited from filing bankruptcy without an attorney, this is not a time to go at it alone.

Do not take the filing of a petition in bankruptcy lightly. These are your financial affairs and your property that you are trying to protect. If you go to Bankruptcy Court and represent yourself, the Trustee and the Judge will presume that ...

Read More...

Increase in New York Exemptions Will Better Facilitate Chapter 7 Bankruptcy Process for Non-Homeowners

In an earlier post, I discussed the benefits that the increase in the homestead exemption will have for homeowners - but what about those who do not own a home? Do not fret - there are also benefits for non-homeowners as well.

In any discussion of exemptions for those who file bankruptcy in New York, there has always been a major tradeoff in what you are allowed to protect when you file bankruptcy - namely, if you are required to claim the homestead exemption, you could not claim any exemption for cash or cash equivalent assets such as checking or savings accounts or the right to receive a tax refund.

Effective January 22, 2011, the ...

Read More...

Increase in Homestead Exemption a Major Boon to Boomers/Retirees

On January 22, 2011, the amount of equity that an individual homeowner in New York State can protect from creditors in bankruptcy shall increase from $50,000.00 to $150,000.00.

This increase could prove to be a major benefit to boomers and retirees in our area who may:

...own their home (including coops and condos) free and clear or have a substantial equity position in their home;

...are either on a fixed income or are at an income level that would qualify them for a Chapter 7 Bankruptcy under the Means Test;

...have considered bankruptcy because of the burdens of credit card and/or other debt obligations, BUT

...have been previously ...

Read More...

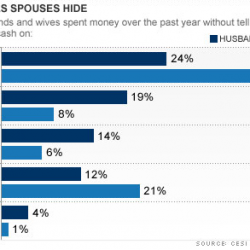

Do You Hide Purchases From Your Spouse?

A few weeks ago, I wrote a blog post discussing the reasons why bills should be spoken about openly in your family. This is particularly important if one spouse becomes ill or even if the family wants to try to keep a monthly budget.

Unfortunately, according to a 2010 survey by CESI Debt Solutions, as reported on Yahoo, approximately 80% of all married people surveyed hide some purchases from their spouses. The most common reason that was listed was to avoid conflict or criticism from their partner. The survey also showed that men were somewhat more likely to do so more often then women. Even though the majority of those surveyed admitted to ...

Read More...

10 Horrible Habits That Will Make a Mess of Your Finances

Many people that find themselves in debt seem to make some common financial mistakes that contribute to their debt problems. According to an article on MSN.com, there are ten bad financial habits that can lead to financial disaster:

Misuse of balance transfers - If you aren’t going to stop charging on your cards, transferring balances to lower interest cards won’t get you out of debt in the long run.

Disregarding your credit report because you think you can’t change it anyway - It is essential that you frequently check your credit report. Small errors made by your creditors could raise your interest rates, lower your credit score and ...

Read More...

Patterson Signs Bill Increasing Exemptions in Bankruptcy

Governor David A. Paterson announced on December 23, 2010 that he signed into law S.7034-A/A.8735-A, which will increase the amount of exemptions in bankruptcy proceedings and money judgments and provide a choice between State and Federal exemptions.

"During this time of economic crisis, it is our responsibility as public servants to protect those who are struggling the most," Governor Paterson said. "A reconsideration of the current exemptions, which in some cases have not been changed in decades, is particularly warranted when an increasing number of individuals find themselves in dire financial condition. Though this is not a perfect ...

Read More...

The College Debt Bubble is Ready to Explode

For the first time ever, student loan debt has surpassed credit card debt. Over the last decade, young people have eagerly received hundreds of thousands of dollars from private lenders working with financial aid offices to earn bachelor’s degrees. According to Yahoo, thanks to easy credit, declining grants and growing tuitions, more than two-thirds of students graduated with debt in 2008, up from 45% fifteen years ago. Outstanding student loan debt ballooned, it grew roughly four-fold in the last decade to $833 billion, with the average debt load being $24,000 according to the Project on Student Debt.

If that wasn’t bad enough, defaults ...

Read More...

Banks Facing Another Mortgage Crisis

Wall Street banks have paid back their federal bailout money and are on the road to recovery, but the financial crisis continues for Main Street banks that small businesses rely on for capital. According to this Barron’s article featured on Yahoo, banks could lose more than $100 billion in another mortgage crisis over the next few years as the backlash from the bailout begins:

The potential liability facing bankers arises from the $2 trillion in subprime, alt-A and option-adjustable rate mortgages that they underwrote and sold to investors, mostly as mortgage-backed securities during the home-lending boom of 2005 to 2007. The losses on the ...

Read More...

- « Previous Page

- 1

- …

- 16

- 17

- 18

- 19

- 20

- 21

- Next Page »

What Makes Me Different From the Others?

What Makes Me Different From the Others?