A few weeks ago, I wrote a blog post discussing the reasons why bills should be spoken about openly in your family. This is particularly important if one spouse becomes ill or even if the family wants to try to keep a monthly budget.

A few weeks ago, I wrote a blog post discussing the reasons why bills should be spoken about openly in your family. This is particularly important if one spouse becomes ill or even if the family wants to try to keep a monthly budget.

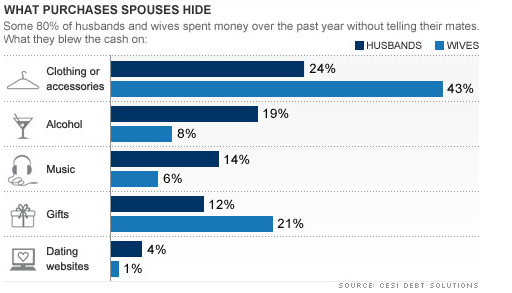

Unfortunately, according to a 2010 survey by CESI Debt Solutions, as reported on Yahoo, approximately 80% of all married people surveyed hide some purchases from their spouses. The most common reason that was listed was to avoid conflict or criticism from their partner. The survey also showed that men were somewhat more likely to do so more often then women. Even though the majority of those surveyed admitted to this wrongdoing, this behavior has the potential to damage your relationship and the couples’ finances. Fortunately there are ways to keep your marriage undivided without revealing every penny you spend.

Most fights about money seem to start with finger pointing, i.e. “How could you spend $500 on a new TV/handbag?” However, according to psychologist Brad Klontz, the object and price are normally not the issue. The argument comes down to a clash of values and this is why people tend to hide these types of purchases from their spouses.

All couples need privacy, but what is really needed is a balance between privacy and accountability. Some couples manage their monthly spending without sharing specific purchases, which is acceptable, but deciding not to tell your spouse about purchases when you’ve agreed to share these types of things is deceptive behavior. This is the type of behavior that can be disastrous to a marriage. If you aren’t sure whether you are acting deceptive, ask yourself “if my spouse found out, would this damage the trust between us?” If you find you have to hide bills or receipts, have a secret bank account or get your kids involved by saying, “Don’t tell Mom/Dad,” it is time to realize these habits are hindering progress towards your common goals as a family.

Like I stated in my recent post about this topic, getting caught up on your family’s finances won’t be a quick process. It is suggested that couples create a “privacy policy” – which can be different depending on the family. This can be anything from specifying a specific dollar amount to spend at a time, a monthly stash of money or a cap on certain spending categories (such as kids or work expenses). Set up a trial period of a month or two and renegotiate the terms until everyone is happy.

What Makes Me Different From the Others?

What Makes Me Different From the Others?