Years ago, if you applied for a credit card, the banks would check your credit based upon one factor – your FICO score. FICO stands for Fair Isaac Corporation. A data analytics company located in San Jose, California. They developed a computer program that determines your credit score. Every time you apply for a car loan, bank loan, mortgage or credit card, your information is fed into one of the ‘Big Three’ credit bureaus, Transunion, Equifax or Experian, who used this formula to determine your credit rating; however, that has changed now, as there are numerous FICO versions available, as well as other companies that have similar formulas for determining your creditworthiness.

How are Credit Scores Calculated?

Every time you make a payment, the amount, date and time of the payment is sent these bureaus, who builds a record of your payments. This information provides the banks with the information needed, as they can see how much you paid, how often you were late (over 30 days), as well as if you have any law suits, judgments or bankruptcies on record and this will determine your credit rating.

Every time you make a payment, the amount, date and time of the payment is sent these bureaus, who builds a record of your payments. This information provides the banks with the information needed, as they can see how much you paid, how often you were late (over 30 days), as well as if you have any law suits, judgments or bankruptcies on record and this will determine your credit rating.

The FICO score varies from 300 to 850. The higher your score, the more favorable you will be with the banks, but there are others, such as the Vantage score. In the earlier VantageScore model, they ranged from 501 to 990, but there is a later one that ranges from 300 to 850.

Whichever scoring model is used, it is safe to say that generally, if your score is in the middle 600s or less, don’t count on getting approved, but if your rating is above 700, you have a very good chance of getting approved. Since there are a variety of scoring models, strive to reach and maintain a score that is consistently over 700.

Who Uses the Vantage Score?

FICO is still popular, but Vantage is gradually taking over the ‘Big-Three‘. So if you request a credit report, make sure to determine which scoring model is being used, so that you can better understand what you creditworthiness is.

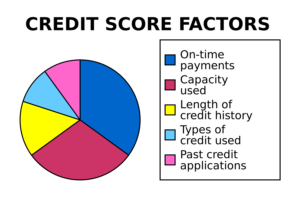

How Do I Make Sure That My Score is High, Regardless of the Credit Model Used?

There are numerous things you can do to keep your credit score high:

- Pay off the balance of your credit cards when you get the bill. This shows that you have enough cash on hand to live comfortably and won’t go into debt. Never pay the minimum amount.

- If you can’t pay the balance of the credit cards off, make sure that the balances are less than 30% of your credit limit. This will show that you are not desperate that you would need money to the point that you are near your credit limit. Customers who have balances near their credit limit or have ‘maxed out’ their limit results in a lower credit score, since the banks would consider you a risk; in the sense that you don’t have the funds to keep your balances low and manageable.

- Pay your bills early. This shows that you have the funds to manage your money comfortably.

- Don’t apply for credit on a frequent basis. These are called ‘inquiries’ and would result in the banks thinking that you are desperate for more money.

- Don’t close out old credit cards, even if you have no balances on them. This helps to show you’ve been around for a while and have a long list of a good credit history.

- Make sure that you have credit from a variety of sources; such as, a mortgage, car loan or lease, bank loan and credit cards.

Bottom Line

Be cognizant of how credit scoring works and what credit model is used when you get a report, but most importantly, make sure your credit rating is as high as possible, so that no matter what scoring system is used, you will always be rated as a valued and trusting consumer.

What Makes Me Different From the Others?

What Makes Me Different From the Others?